coreIDENTITY™ offers a comprehensive and highly configurable suite of identity solutions for the full customer lifecycle. From acquisition and verification to onboarding and beyond, our tools and customizable workflows deliver robust consumer insights.

Identity solutions tailored to your needs

Confident decisions enabled by trusted identity insights

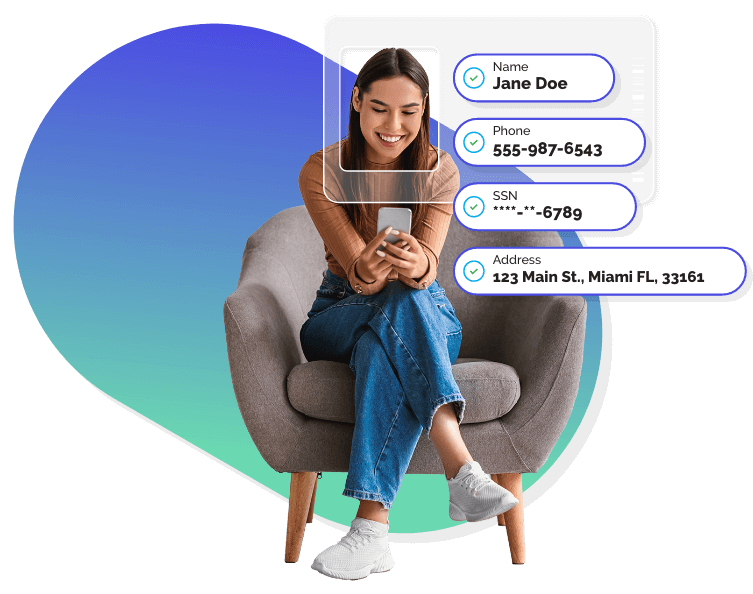

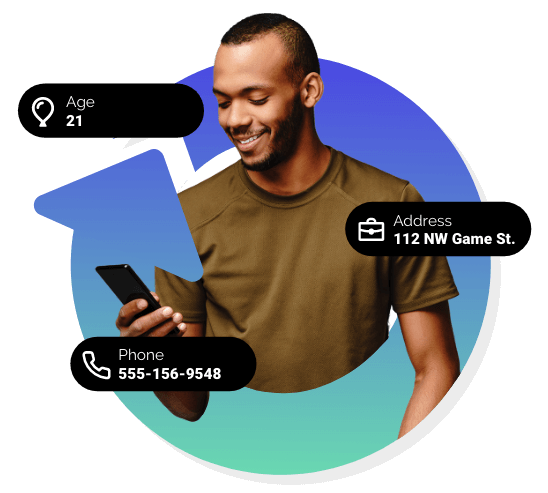

Identity verification

Reduce onboarding friction, stop fraud, and transact in real time with confidence, leveraging AI/ML-driven identity intelligence capabilities and an exhaustive repository of identity data for maximum accuracy. Verify:

- Name

- Phone number

- SSN

- Address

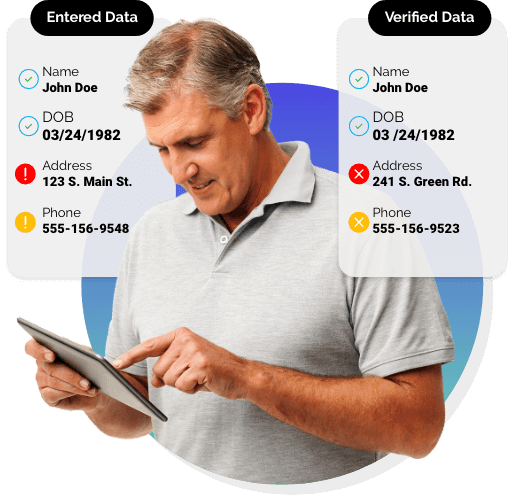

KYC

Meet KYC and AML compliance requirements and effectively separate legitimate consumers from potential bad actors, helping to reduce costs, increase approval rates, and improve customer satisfaction.

- Identities are checked against IDI’s comprehensive data assets and major sanctions lists.

- Improve decision making and reduce manual review costs with additional contextual information, fraud flags, and reason codes.

- See how often an identity has changed over several years, a common indicator of fraud.

- Use match and identity scores to seamlessly integrate with decision and analytic engines, improving passthrough rates and supporting manual review dispositions.

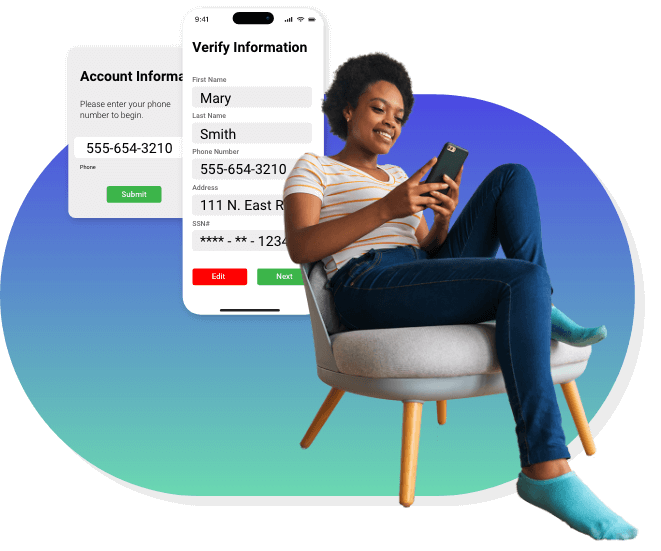

Pre-fill

Pre-populate application forms with verified identity data to reduce consumer friction and fraud and increase conversion rates. Satisfy consumer privacy expectations using only a phone number match, or another identity attribute, and verify the consumer before a form is completed.

Fraud signals and risk scores

Proactively prevent fraud without compromising customer experiences through real-time consumer analysis and signals that reflect risks associated with individuals and devices. See varying levels of risk from first-party fraud to third-party to synthetic IDs.

Data refresh

Maintain an accurate, up-to-date consumer database with ongoing data cleanup from the most advanced identity intelligence platform available. Manage consumer contact information that commonly changes like phone numbers, devices, and other identity attributes to improve contactability and the consumer experience.

Identity monitoring and event triggers

Monitor identities across data elements and receive notifications for changes in a consumer’s PII information, when a significant life event is detected, or when new fraud indicators are found. Continuous, automated monitoring ensures quick mitigation of risk and uninterrupted compliance.

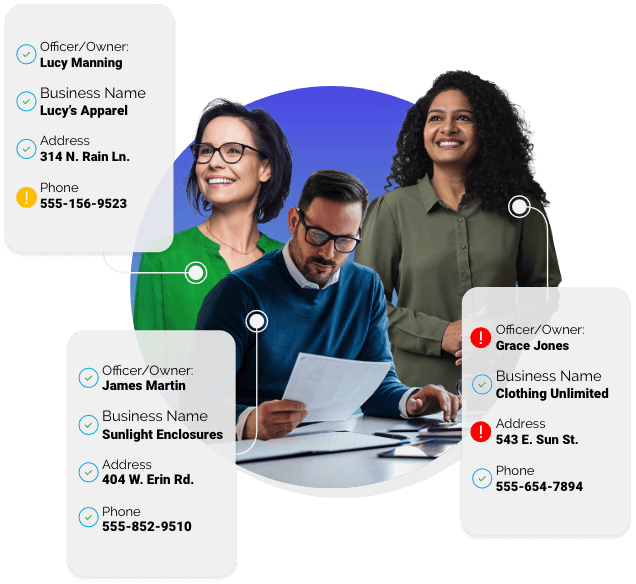

KYB

Confidently verify businesses you’re working with and the people behind them. Our differentiated solution allows you to not only perform a traditional verification using the entity or business details, but also through an initial KYC verification of the principal owner(s) and associated business. This allows you to see information on any owners associated with the business, providing superior coverage, particularly for small businesses and sole proprietorships.